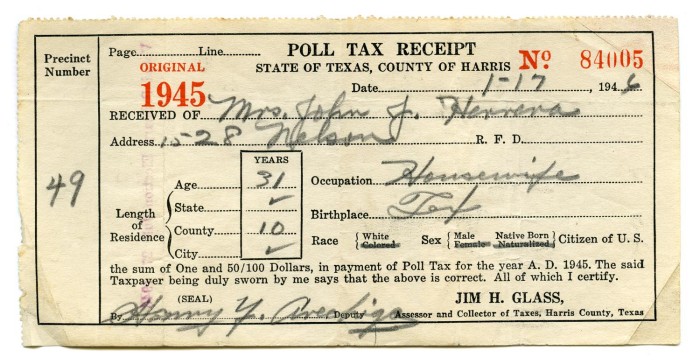

Image from the Portal to Texas History

By 1920, all citizens of Texas had the right to vote, at least on paper. But the reality was that minority Texans, Texans disenfranchised by poverty, and some Texas women were still barred from the ballot box, despite the guarantees allegedly offered by the 15th and 19th Amendments.

One of the most effective means of suppressing voters (in addition to the “whites only” primary election system that wasn’t struck down until the 1940s) was the poll tax, a fee imposed on citizens that had to be paid in full in order to receive a ballot.

Today, the notion of having to pay for the right to vote is shocking, and seemingly in contradiction with the concept of a free society. But for generations of 19th and 20th century Texans, the poll tax was an annual financial and civic duty burden that they had to remember to take care of—and in many cases, save and sacrifice for, if they wanted to have access to their full rights as citizens.

The origins of the U.S. poll tax actually date back to colonial times, when the tax was levied primarily as a means of generating revenue for the government, and wasn’t always linked directly to voting. But in the post-Civil War era and after the passage of the 19th Amendment, poll taxes were administered widely across the U.S., particularly in the South, as part of a codified effort to keep the ballot in the hands of white men and upper middle class and affluent white women, who were believed to be likely to vote in the same direction as their husbands and fathers.

Although the fee usually only a few dollars, that was a significant amount of money in this era, sometimes representing a substantial portion of a family’s household income for the month. To make matters worse, some jurisdictions erected further barriers by requiring the poll tax to be paid in cash or in hard-to-reach or intimidating locations, such as the police station.

The poll tax practice persisted in Texas until 1966, when it was finally abolished once and for all via a special resolution of the Texas Legislature repealing the administration of poll taxes for state and local elections.

In 1964, state governments ratified the 24th Amendment, which prohibits federal or state government from conditioning the right to vote in federal elections on the condition of payment of any type of tax.

Additional Learning: “Why Did Texas Have a Poll Tax?”—the Dallas Morning News